What Does COB Mean in Business?

Learn what COB means in business, its deadline usage, time zone differences, and how to use Close of Business correctly in emails and contracts.

Is finance a good career path? Explore salary, job scope, growth opportunities, skills needed, and why finance offers strong stability and rewards.

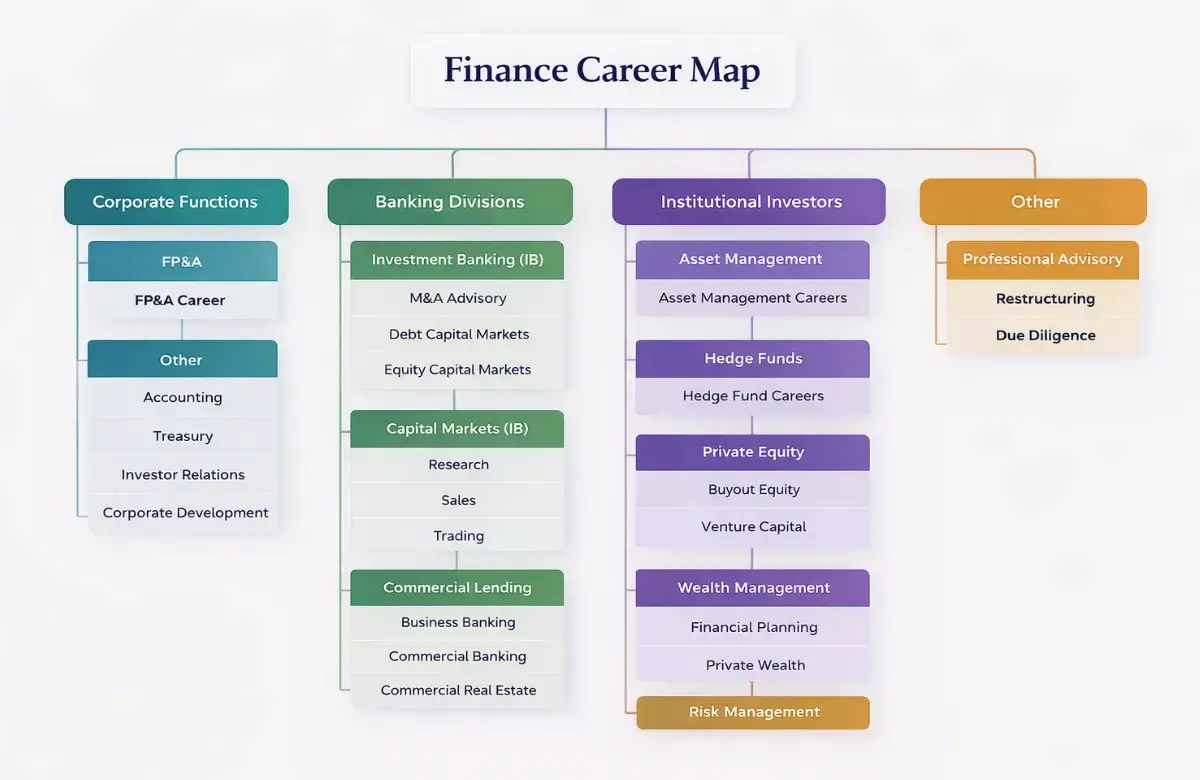

In today's fast-paced world, choosing the right career is crucial. Is finance a good career path ? The response would be frequently yes, particularly because this sector is experiencing increased financial literacy, fintech advances , and increased growth owing to digital banking . Finance specialists deal with individuals, businesses , and governments in terms of money, investment , and risk management . The industry will have good remuneration, mental challenges , and employment stability through economic transitions. With the rising GDP of India and the rise in the number of startups, there is an increasing need for skilled financiers, and hence, it would be an attractive option for both graduates and career switchers.

Table of contents [Show]

It is a good career because of its diversity and remuneration. Roles cut across banking, investments, corporate finance , etc., allowing the professional to work in vibrant environments such as the stock exchange or in the quiet advisory firms . This has resulted in high demand as no business can prosper without financial expertise. The initial positions have good remuneration , and experience brings in the positions of executive that present a salary approaching six figures. Nonetheless, to succeed, one must be continuously educated to remain abreast of rules and technology such as AI-based analytics . All in all, finance is a profession that is good when a person likes numbers, strategy , and solving problems .

Studying finance would lead to financial stability and power . The best ones are high-paying salaries with initial pay that tends to be higher than in other jobs. Stability of the jobs brightens even in the time of recession since businesses focus on cost containment and investment. Various directions allow specializing in such fields as sustainable investing or risk exposure , and following individual preferences. Another advantage is global mobility- talent is moved across boundaries with ease. The best chance to network comes in the form of conferences and firms, which offer a connection for a lifetime. Lastly, people find the working process to be interesting due to the intellectual excitement of predicting markets and investing in multimillion-dollar business cases.

The world of finance presents many different types of jobs, including those of analysts who crunch data and those of executives who help set a corporate strategy. Salaries are also based on experience, location, and size of the firm, with high premiums being paid in metros such as Mumbai and Delhi. The following table contains a list of typical positions in India and their estimated yearly pay rates:

Job Title | Description | Entry-Level Salary (₹ Lakhs) | Mid-Level Salary (₹ Lakhs) | Senior-Level Salary (₹ Lakhs) |

|---|---|---|---|---|

Financial Analyst | Analyzes data for investment decisions | 4-7 | 10-18 | 25-50 |

Investment Banker | Handles mergers, acquisitions, and fundraising | 8-15 | 20-40 | 50+ |

Accountant | Manages books, audits, and taxes | 3-6 | 8-15 | 20-35 |

Risk Manager | Identifies and mitigates financial risks | 6-10 | 15-25 | 30-60 |

Portfolio Manager | Oversees investment portfolios | 7-12 | 18-30 | 40-80 |

Credit Analyst | Evaluates loan applicants' creditworthiness | 4-8 | 12-20 | 25-45 |

Wealth Manager | Advises high-net-worth clients on assets | 5-9 | 15-28 | 35-70 |

Fintech Developer | Builds apps for payments, blockchain finance | 6-11 | 16-30 | 40+ |

Compliance Officer | Ensures regulatory adherence | 5-8 | 12-22 | 25-50 |

CFO (Chief Financial Officer) | Leads the company's financial strategy | N/A | N/A | 80-200+ |

These figures draw from industry trends and reflect averages; top performers at firms like HDFC or Goldman Sachs earn bonuses doubling base pay.

Finance has clear advantages but isn't without challenges. The table below weighs both sides:

Pros | Cons |

|---|---|

High earning potential with bonuses | Long hours, especially in peak seasons |

Job security and demand | High stress from market volatility |

Intellectual stimulation and variety | Intense competition for top roles |

Global opportunities and travel | Constant need for upskilling |

Clear career progression ladder | Regulatory changes add complexity |

Impactful work influencing economies | Work-life balance can suffer initially |

Despite cons, pros often outweigh them for driven individuals.

Finance welcomes analytical minds passionate about economics and markets. Ideal candidates excel in math, enjoy research , and thrive under pressure . Strong communicators shine in client-facing roles. Here's a table of key qualifications with durations:

Degree/Course | Duration | Focus Areas |

|---|---|---|

B.Com (Bachelor of Commerce) | 3 years | Accounting, economics, business basics |

BBA in Finance | 3 years | Management, financial planning |

MBA in Finance | 2 years | Advanced strategy, investments |

CFA (Chartered Financial Analyst) | 2-4 years (3 levels) | Portfolio mgmt, ethics, analysis |

CA (Chartered Accountancy) | 4-5 years | Auditing, taxation, auditing |

FRM (Financial Risk Manager) | 1-2 years (2 parts) | Risk assessment, markets |

CPA (Certified Public Accountant) | 1-2 years | International accounting standards |

PGDM in Finance | 2 years | Banking, corporate finance |

Diploma in Banking & Finance | 1 year | Operations, compliance |

Fintech Certifications (e.g., CFI) | 3-6 months | Blockchain, digital payments |

Start with a bachelor's, then pursue certifications for the edge. Top institutes like IIMs or the CFA Institute boost prospects.

Critical abilities involve analytical capability to deconstruct the financial reports and predict trends. Skills are in Excel, Python, or Bloomberg terminals , which manipulate data effectively. Communication skills convey complicated concepts to non-experts. Ethical judgment maneuvers through laws and regulations, such as SEBI guidelines. Adaptability also includes such fintech disruptions as UPI or robo-advisors . High positions are driven by soft skills such as teamwork and leadership. Hone these with internships, distance courses, and the real world.

Finance and accounting are similar, though they differ in nature. Historical transactions are traced through accounting, which involves the recording of income, expenses, and compliance through ledgers. Finance is prospective , and it considers investments, value maximisation , and the decisions of funds . Accountants are in charge of tax accuracy, and financiers plan budgets and mergers. Seek accounting accuracy, finance influence. Both of them require math skills, but have more extensive and higher-paying options in the field of finance.

The question “Is Finance a Good Career Path?” Yes, Finance is a good profession with a combination of rewards, growth, and relevance. As the financial sector of India is expected to grow through a digital transformation and green finance, there are opportunities. Assess your skills with the demand, seek appropriate education, and invest into life long learning.

Welcome to Growveea — a growing digital platform led by Amelia Williams and the Growveea Team with over 10+ years of experience in content publishing. We create well-researched and engaging content across Celebrities, Business, Life & Style, Entertainment, Movies, Music, TV, K-Drama, and K-Pop, with one simple mission — to inform, inspire, and keep our readers ahead of trends.

Learn what COB means in business, its deadline usage, time zone differences, and how to use Close of Business correctly in emails and contracts.

Learn what a business analyst does, including key roles, skills, tools, daily tasks, and career growth in today’s data-driven industries.

Wondering what to do with a business degree? Explore career options, salary potential, in-demand skills, and growth opportunities across industries.